Interest Rates: What they are and how they’re causing the layoffs

There is a lot going wrong in the games industry right now, but it always surprises me when I see posts on social media that are SHOCKED another round of layoffs hit another studio, seemingly every week. But, it shouldn’t be that surprising because the root of this evil is, of course, Money.

More specifically, Free Money.

Backing up a bit, you’ve probably come to this post wondering about the main question: “What are Interest Rates, and how the heck did they cause the layoffs?” So to start, let’s introduce the Federal Reserve, or as we in Finance like to call it, the Fed. The Fed is the Central Banking system here in the United States. If you’re from elsewhere, you also likely have a central bank. But sorry, I’m just talking about the US here.

These days the Fed has lots of powers it can wield over the Economy, trying to make that nasty “Invisible Hand” a little less invisible. But the Fed’s main power is to print money!

Side note, here’s a fun party trick: Pull out a $1 bill, look for the big capital letter left of Washington’s face, and you can see which local Fed printed that bill. Make it a game by seeing who in the group has one from the farthest away.

Another power the Fed enacted was requiring Banks to keep a certain amount of cash on hand. This is mainly to help protect against Bank Runs, the lack of which caused some Crypto firms to crash. But, it’s also because the Fed gets to hold onto that money and SET the Interest Rate for those accounts. Just like you or I can go to a bank and get a savings account with a certain interest yield, so too can banks go to the Fed and get one. So you can think of the Fed as the bank of the Banks.

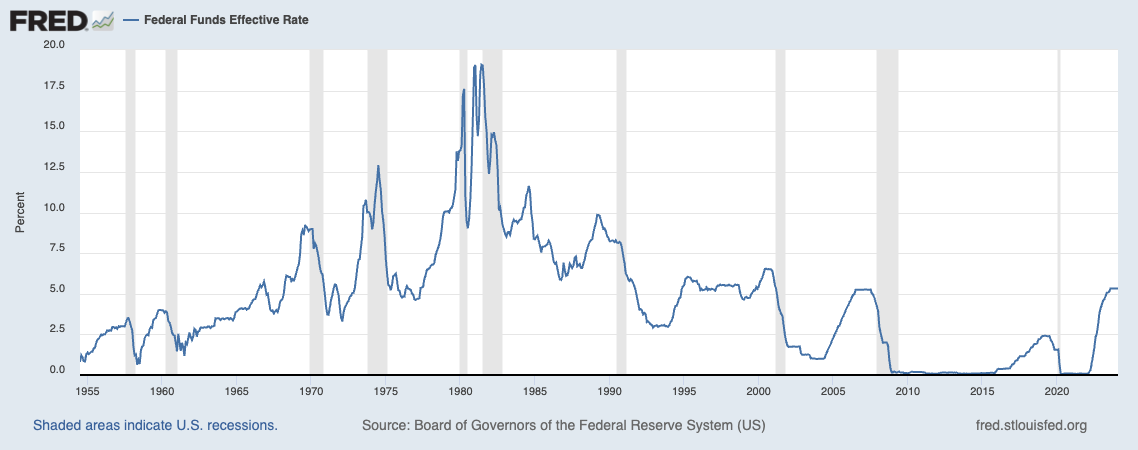

With these powers over the Supply of Money and setting these Interest Rates, the Fed can attempt to "Steer the Economy" in one way or another. Their goals are usually to try and curb Inflation and keep Unemployment low. Usually. Here’s a graph from FRED showing the history of US interest rates.

You can see it’s been all over the place. Those gray bars show periods of Recession. Rates usually go down during those times, so it’s easier to spend money. More on that in a second.

You can see after 2008, rates fell to HISTORIC lows of near zero. That means, as a bank, your money with the Fed isn’t gaining any interest. Remember that. You can also see where policy makers got scared in 2020 due to the pandemic and reduced rates back down to near zero again! But within the last 2 years look how quickly they’ve gone back up…

Now investors keep a close eye on these rates because of the idea of a “Minimum Return”. If your bank is giving you 5% interest to keep your cash with them, but you as an investor want to invest that cash elsewhere, it better earn more than 5% otherwise you’ve lost. Those Interest Rates set a BASE return that an investment will make.

When rates were ZERO it was easy to raise investor money because the Investors didn’t want to hold onto their cash while it’s making them a ZERO rate of return. You as a company only had to be making more than 1% to beat ZERO percent and earn a real return.

With the “Free Money” flowing, all that cash had to go SOMEWHERE. During the pandemic companies didn’t need to buy up real estate for offices. Equipment and software tools aren’t that expensive. So you BUY people. Hire up your teams as the best path for growth-related opportunities, as that money’s gotta go somewhere…

OOPS! Interest Rates are now above ZERO. Who could have predicted that wouldn’t have lasted forever? Worse yet, they are still going up at a higher rate than ever before. So remember that required “Minimum Return”? You’d better be making more than that otherwise your company will be kicked to the curb by investors.

Companies made a calculated decision to BUY (hire) folks when money was cheap. And now they are trying to return what they bought. But unlike office chairs, you can’t just take your PEOPLE back for store credit. Lives are getting hurt.

To the executives, it didn’t seem like a bad idea at the time. Companies that didn’t go on hiring sprees aren’t doing these massive layoffs. And there is still great growth in the games industry. Just maybe not VC style growth… but we will save that for another post on another day.

--- John

Explore more posts...